FSG may have handed Liverpool a brand new transfer budget as Michael Edwards 'promised' January funds

January spree incoming? ????

With Arne Slot riding the crest of a wave on the pitch after a modest first summer transfer window in charge of Liverpool, could FSG be set to push the boat out in the January window?

Liverpool, who waited until late in the window to sign Federico Chiesa and Giorgi Mamardashvili from Juventus and Valencia respectively – ended the summer with a positive net spend.

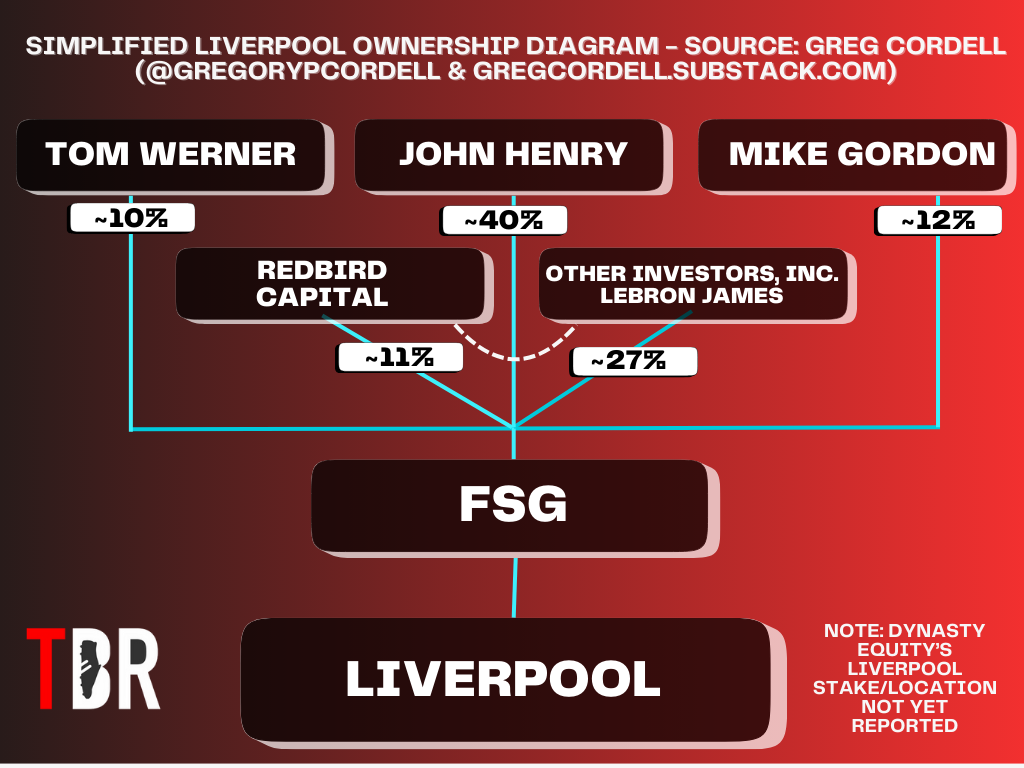

Fenway Sports Group (FSG) are known as prudent operators in their player trading model, with financial sustainability and value the priorities ahead of Hollywood signings that lead to wage inflation.

That restrained approach is partly the reason that three club legends – Trent Alexander Arnold, Mohamed Salah, and Virgil van Dijk – may be in their last season at Liverpool.

From January, all three will be permitted to sign pre-contract deals with overseas clubs. For other Premier League clubs, meeting their wage demands might be a no-brainer, but not for FSG.

Particularly for Salah and Van Dijk who are both in their 30s, FSG may be reluctant to commit to huge new deals that would disrupt their rigid wage structure.

Granted, replacing either player would cost them oceans of cash too, but the Boston-based investment company’s view is that bowing to their demands can lead towards a Man United-style wage spiral.

FSG’s number-one aim, as frustrating as it might be for fans, is for the club to be profitable or break even.

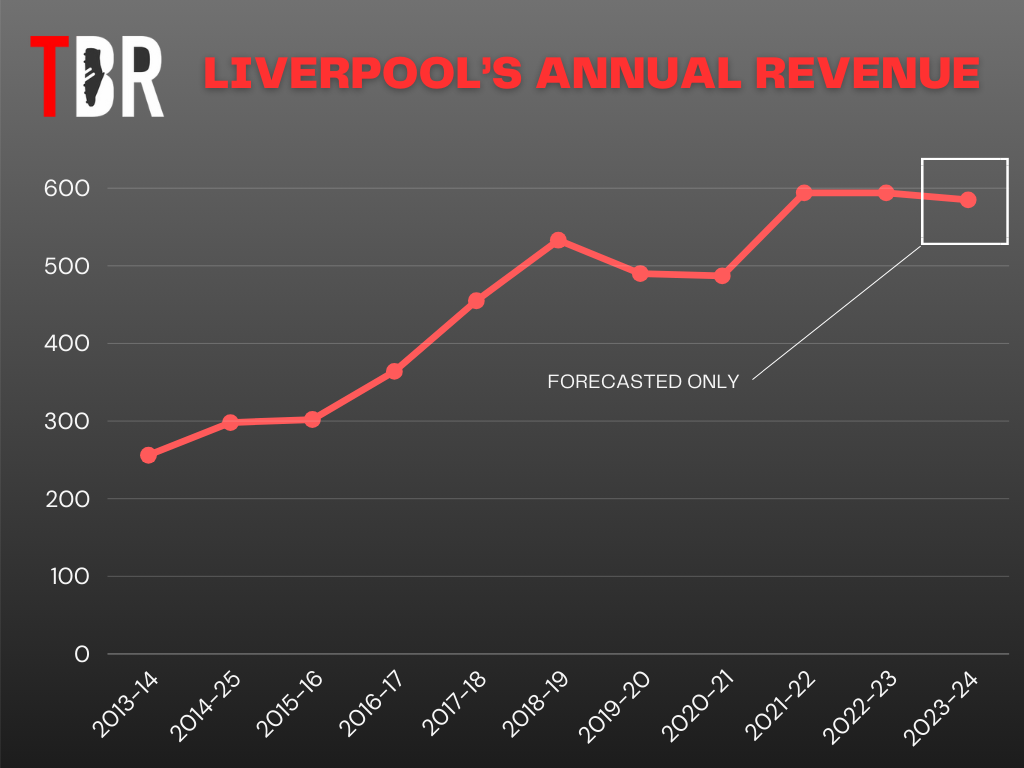

Success on the pitch, however, is a massive variable in the world of football finance, and budgets change accordingly.

With Liverpool having all but qualified for the knockout stages of the most lucrative Champions League in history and Arne Slot’s side flying in the league, some have suggested FSG may have revised the budget.

Profit and Sustainability Rules (PSR) is not even on Liverpool’s radar as a concern and the owners have sufficient liquidity if they did choose to invest in recruitment and retention in January.

Elsewhere in their sports empire, the words of the FSG CEO Sam Kennedy, as quoted by the Boston Globe, may provide some indication of their mindset.

Liverpool owners ‘intend to invest’, says CEO

Kennedy was closely involved in the deal that saw FSG buy Liverpool for £300m in 2010.

The executive, who is president of FSG’s Major League Baseball franchise the Boston Red Sox, has since joined their ranks as a partner and was later named as their CEO.

The Red Sox endured a torrid season in 2024, with their failure to reach the play-offs prompting calls among fans for FSG to put their hands in their pockets.

And Kennedy’s rhetoric suggests that they may well acquiesce, in a gear change that may bode well for Liverpool’s hopes of FSG backing Slot in January.

“Even if it takes us over the CBT (competitive balance tax that stands at $241m),” he told the Globe.

“Our priority is 90 to 95 wins, and winning the American League East, and winning the division for multiple years.”

“Is that possible? If that’s what it takes, yeah, absolutely. We are investing more than we did last year. We intend to invest going forward.

“There is an extreme urgency internally to be competing for the American League East Championship and to set ourselves up for a deep postseason run in 2025 without question.

“The goal is to win 90 plus games to not be worrying about a wild-card spot.”

Michael Edwards will have received funds pledge from FSG, says finance expert

When former sporting director Michael Edwards returned to Anfield in March, this time as CEO, it was widely reported that it was on the proviso of giving him the freedom to establish a multi-club network.

Speaking exclusively to TBR Football, Liverpool University football finance lecturer and industry insider Kieran Maguire suggested that the 45-year-old will also have been given reassurances about funds.

“No club does more forensic analysis than Liverpool,” he said.

“They will be revising their budgets given the excellent start to the season and the significant benefits of winning games instead of drawing games in the Champions League, which is worth a lot of prize money.

“They have already qualified for the knockout phase of the Champions League, but substantial bonuses will still arise.

“You only have to look at the ticket prices for the Real Madrid game to see that they are conscious of maximising revenue.

“They are under pressure from fans with regards to the three big contracts that are up for renewal in the summer.”

“They have got Michael Edwards there now, who is an excellent negotiator. He would not have gone back to Liverpool had he not been promised a competitive budget.

“I think the budget was there already, so I don’t think there will be a significant budget but it will be towards the top end.”

What's Your Reaction?