Major Newcastle United finance update as £57m deal confirmed

Done deal. ✅

Newcastle United have received a major financial update from an official source that shows just how far they have come under the Saudi Public Investment Fund.

It has been almost three years since PIF bought Newcastle, taking over from public enemy number one on Tyneside, Mike Ashley.

Things could hardly be more different than under then the high street tycoon, with his perceived lack of ambition replaced by plans to make Newcastle one of the best in the world.

The club have been anchored by the Premier League’s Profit and Sustainability Rules (PSR), which in their current form limit clubs to losing £105m over a rolling three-year period.

They have been forced to raise revenue, through commercial and matchday streams, both of which have now almost doubled in the PIF era.

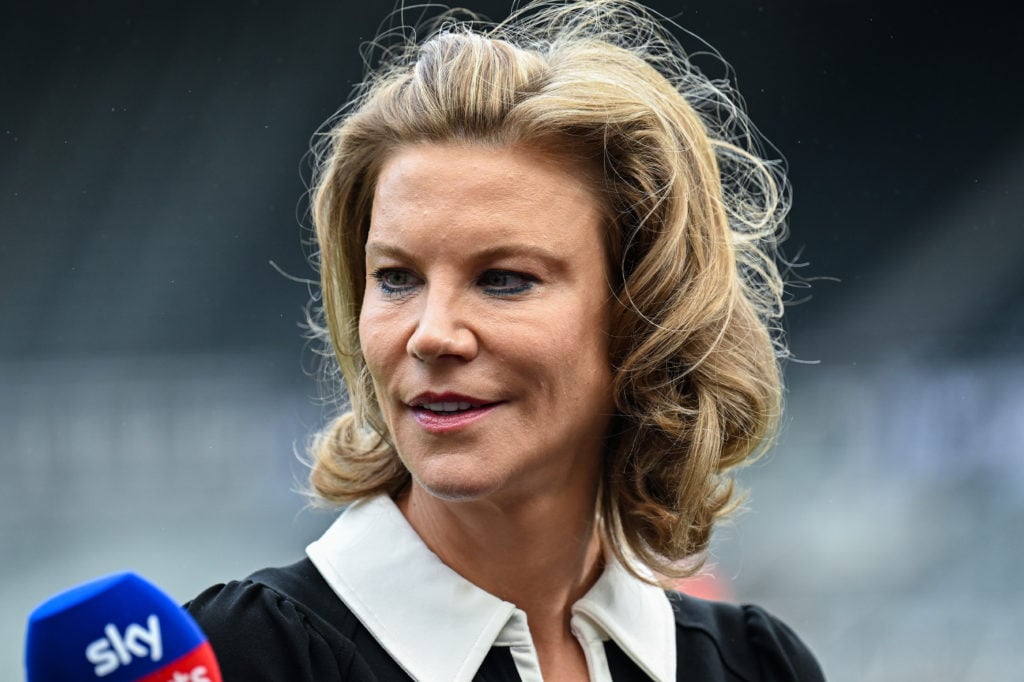

The architect of those gains was Amanda Staveley, the public face of the takeover who took a directorial position and a minority stake in the club after the deal was finalised.

Staveley’s exit from Newcastle was confirmed earlier this month, and the Middle East dealmaker is now believed to be considering investing in another Premier League club.

Her connections in the Gulf are peerless in the world of sport. And the latest developments show that her time at Newcastle has been a riotous financial success.

- READ MORE NEWCASTLE NEWS: Kieran Maguire issues verdict on Newcastle renting Sunderland stadium during St James’ Park rebuild

Newcastle valued at £1bn after £57bn deal

When PIF, the Reuben Brothers and Staveley’s PCP Capital Partners bought Newcastle, they paid £305m for a club with no debt, a global profile and one of England’s biggest stadiums.

That fee is, according to most models, is a bargain.

And a new report from Bloomberg suggests that the club’s powerbrokers now suggests that they value it at £1bn.

If the club was sold at that price tomorrow, it would be the second-most expensive takeover of all time.

That figure also means that Staveley’s sale of her 5.7 per cent stake to the Reuben Brothers will have been worth £57m, considerably more than she initially paid for it.

Paradoxically, Staveley took a loan from the Reuben Brothers to acquire her stake, which she has now paid back using the funds from the sale to the same group.

Staveley is not necessarily cash rich, however.

She has raised £500m for a new football acquisition, but that is PCP Capital Partners’ money, not hers.

Staveley also faced a bankruptcy petition earlier this year, which she is currently appealing.

TBR Analysis: Why has Newcastle’s value risen so steeply?

To exceed 3x value in three years is a remarkable achievement.

Football club value is subjective, but PIF know about valuing businesses given that they are probably the single most prolific mergers and acquisitions operators in the world.

The increased value reflects Staveley’s excellent work in the commercial department, as well as the improvements to the physical and sporting infrastructure at the club.

The value of the squad, which is almost always a club’s biggest single source of value, is also a massive driver.

There have been next to no transfer flops in the PIF era, with most players increasing in value – some dramatically so.

What's Your Reaction?