PIF's so-called 'spending cuts' could actually see them pump billions into Newcastle United

When headlines began to circulate about the Saudi Public Investment Fund (PIF) tapering their foreign investment earlier this week, Newcastle United fans were naturally worried....

When headlines began to circulate about the Saudi Public Investment Fund (PIF) tapering their foreign investment earlier this week, Newcastle United fans were naturally worried.

There have been suspicions within football’s business ecosystem that PIF were going cold on Newcastle, where their ambitions have been suffocated by Profit and Sustainability Rules (PSR).

The Premier League’s spending rules cap financial losses at £105m over a rolling three-year period.

Exceeding that threshold, as Everton and Nottingham Forest have discovered, can lead to a fine or points deduction.

In 2023-24, Newcastle were wobbling on the precipice of a breach but managed to eventually keen within the limit, thanks in part to the PSR-boosting sales of Elliot Anderson and Yankubah Minteh.

Eddie Howe was deeply frustrated at losing two rising stars, with their stellar performances at new clubs Nottingham Forest and Brighton pouring salt on the wound.

Indeed, Anderson could be in line for his first England call-up.

But those sales were not a signal of PIF’s dwindling ambitions at St James’ Park. The opposite, in fact.

It was only because the sovereign wealth fund spent all the way up to the PSR limit, as Newcastle CEO Darren Eales said they always would, that they found themselves in that position.

Selling two brilliant young talents might have been a result of an error of strategy but not of ambition.

There have been other whispers about PIF’s interest in Newcastle waning, with the suggestion that their focus is squarely on the 2034 World Cup, which will be staged in Saudi Arabia.

But with almost £700bn worth of assets under management and interests in Formula One, heavyweight boxing, snooker, tennis, and just about every other sport under the sun, PIF are used to juggling projects.

The context of that setup and how they have managed it historically made suggestions that PIF were set to slash funding in Newcastle less credible.

- READ MORE: Newcastle join race to sign defender who left Nottingham Forest in 2023 with Liverpool also keen

Clarity on PIF’s Newcastle funding stance

Newcastle are arguably PIF’s flagship investment in sport, or at least their most explicit statement of intent.

When Yasir Al-Rumayyan, who is both chairman of Newcastle and governor of PIF, made the comments that have sparked headlines, he was talking at the fund’s annual convention.

“Initially we had less than 2 percent of investments internationally, that was with $150 billion assets under management,” he said.

“Then it increased from 2 percent to 30 percent. Now our target is to bring it down to 18 to 20 percent.

“Having said that, the absolute dollar amount is still growing. It was a rollercoaster down and up and down as a percentage, but the dollar amount is increasing,” he said, noting PIF’s assets under management are now around $930 billion.”

The key element of the quotes is that while proportionately PIF’s foreign investment may be going down, the “dollar amount is increasing.”

And while the absence of any explicit reference to Newcastle means we cannot say for sure whether they will continue to fund the club at the rates they have, subsequent reports would suggest so too.

How can Newcastle carve out more room under PSR?

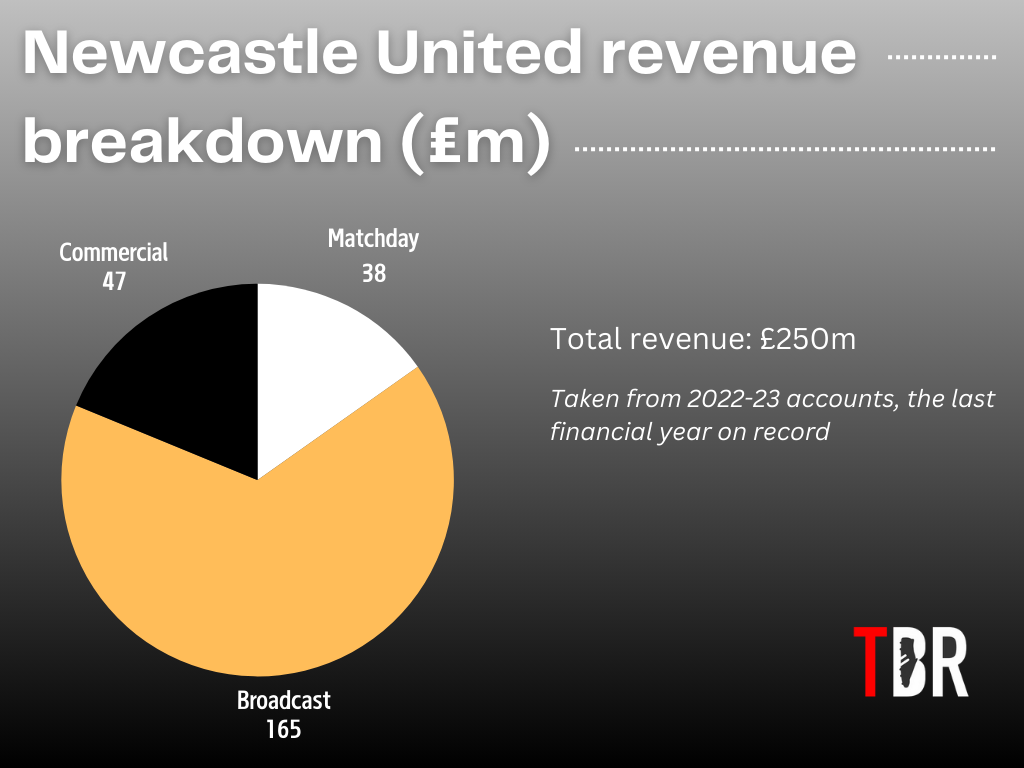

Newcastle’s revenue in 2022-23, the last year for which financial data is available, sat at around £250m.

When their figures for 2023-24 are released early next year, they will reflected a season of lucrative Champions League revenue and a maturing commercial strategy.

PIF are also planning to expand St James’ Park or potentially even build a new stadium altogether.

While that would be a likely £1bn investment for PIF – and not the kind they would sanction if their interest in the club was waning – it would also increase matchday and commercial income by an order of magnitude.

The frustration is that the stadium will take years to construct, so matchday income is a largely static income stream for now.

Commercial income is the one element of their business operation that does not have much of a concrete ceiling in place.

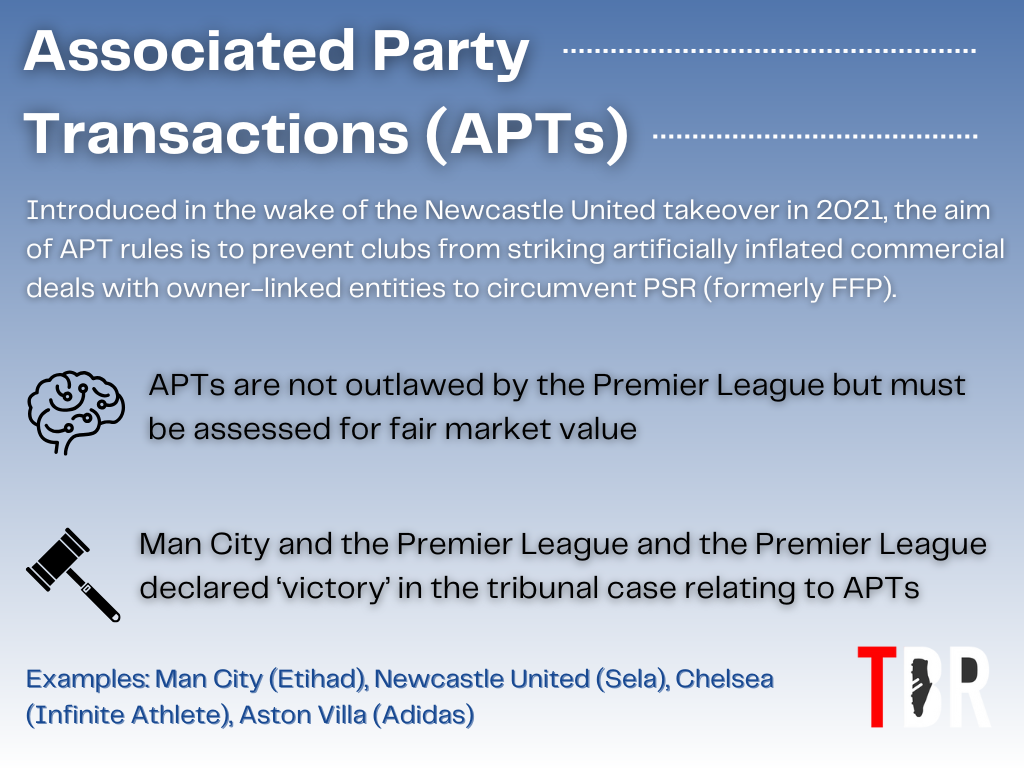

The fallout from Man City’s challenge to the Premier League’s Associated Party Transaction Rules could also provide scope for more lucrative sponsorship deals with PIF-linked businesses.

There is no quick fix for Newcastle’s PSR deficit, however.

And with a new PSR system which ties spending more closely set to be introduced from

What's Your Reaction?