The truth about Tottenham's '£50m Netflix deal' and what it means for Ange Postecoglou's January budget

????????

‘Premflix’, a direct-to-consumer streaming service, has gained significant traction in recent years. As probably the Premier League’s best commercial innovators, Tottenham are intrigued.

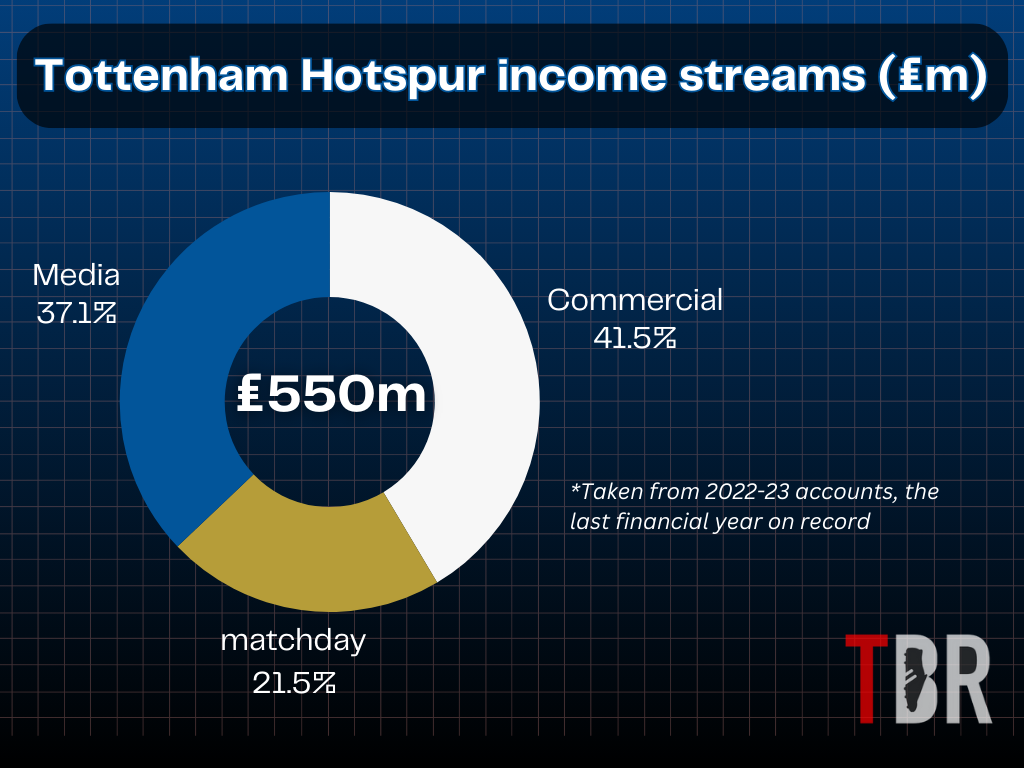

Broadcast income has been the Premier League’s golden goose in the modern era, with the next rights cycle set to be worth over £12bn. At the last count, Spurs’ annual media income was £204m.

In the last financial year for which the club have published their accounts, 2022-23, that equated to around 37 per cent of Tottenham’s overall turnover of £550m.

In previous years, the proportion has been far greater. Indeed, for most Premier League clubs, media income is by far the biggest earner.

For Bournemouth, whose revenue was the lowest of any top flight club in the last recorded financial year, revenue from TV and streaming accounted for 86.5 per cent of their turnover.

As with all the elite clubs, Spurs are consciously diversifying, ploughing more resources and man-hours into spinning a wider and more elaborate commercial web.

Granted, it’s dry. It’s technical, yes. Absolutely, it’s buzzwords that most bedrock Spurs fans couldn’t care less about. But stay with me.

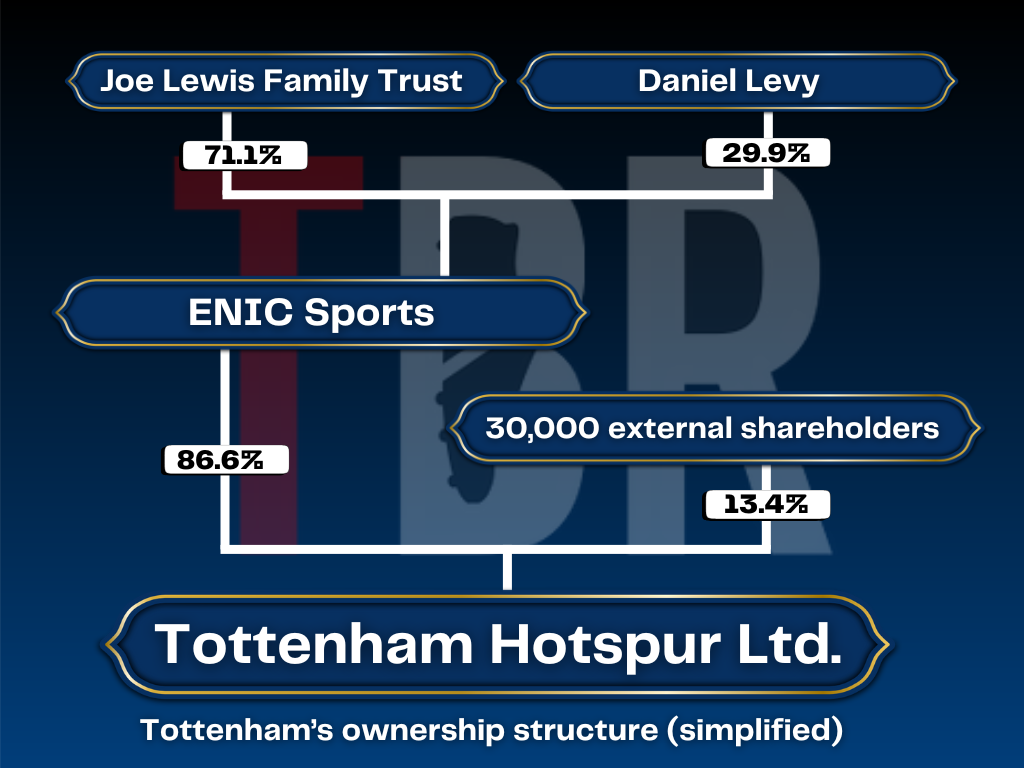

Ultimately, Daniel Levy and ENIC want the Spurs to be self-sufficient, so Ange Postecoglou’s budget is entirely contingent on how much they earn.

Many Tottenham supporters are sick of the Levy-ENIC regime over-indexing their sponsorship and ticketing strategy against results on the pitch – and justifiably so.

But the reality is that – unless in the unlikely event that Amanda Staveley swoops in and invests in Spurs – this will be the North London club’s model for the foreseeable future.

Predominantly, Tottenham are concentrated on their own business, as opposed to cooperating with their peers in the Premier League for mutual benefit, as is the dynamic in US franchise sport.

However, there are rare moments of consensus at Premier League HQ. The move towards a streaming model and the league as an entertainment brand appears to be one of them.

Earlier this year, the Premier League announced that, from 2026-26, it will be taking its international media rights in-house, ending their two-decade partnership with IMG.

In layman’s terms, they are launching an OTT streaming service through which overseas viewers will pay to watch the Premier League matches.

It’s a big, bold move, even if it won’t change anything for us at home. The Premier League’s international rights are worth £6.7bn per cycle. That is more than the domestic deals with Sky, TNT, and Amazon.

Readers will be aware of the Netflix and Amazon Prime-commissioned documentaries that have featured a smattering of Premier League clubs in recent years, including Tottenham.

have been an entry point for the Premier League to realise the value of creating their own content and curating their own – here’s another buzzword – narrative.

Clubs are looking at this on an individual basis too.

The Premier League’s biggest fish have all explored the possibility of selling their own media rights, although how exactly this would be achieved is up for debate.

One of the proposals of both the European Super League in 2021 and Project Big Picture a year earlier, both of which had the support of Spurs at the time, was a provision to sell matches direct to viewers.

And Tottenham’s flirtation with the world of OTT streaming, interactive content, and subscription-based services has taken a step forward in recent days.

The real value of Tottenham’s new Netflix partnership

Earlier this week, Tottenham announce a commercial tie-in with the Netflix’s Squid Game series, whose second series will imminently be released on the streaming platform.

The optics, given the ongoing protests against ENIC and with Postecoglou’s side in erratic form, were not great and the marketing gimmick has prompted a debate about the club’s commercial orientation.

While most fans, it is fair to say, think the Squid Game announcement is a microcosm of a failing culture at Spurs, where the silver screen is prioritised over silverware.

Others have argued that the club have to dine with the devil to some extent and more commercial wins will ultimately equate to more success on the pitch.

There is some merit to that argument, but equally there have been some pie-in-the-sky figures cited in relation to the new Netflix partnership.

One widely circulated article quoting a former Spurs scout suggested the deal could lead to a new Netflix documentary worth £50m. That is well, well wide of the mark.

Universally, experts consulted by TBR Football, including Liverpool University football finance lecturer Kieran Maguire, have said the value of such a deal would be far more modest.

For context, TBR understands that the Amazon Prime All Or Nothing series focused on Spurs was worth just north of £10m.

That was a full, nine-episode with unprecedented access, not a fleeting experience-based commercial deal. Values have perhaps risen somewhat in the intervening years, but not close to 400 per cent.

- READ MORE: Sheikh Jassim’s emphatic Tottenham takeover stance emerges after £5bn Man United bid collapse

Spurs commercial income and its effect on Ange Postecoglou’s January budget

With Spurs in mid-table approaching the halfway point of the season, Ange Postecoglou and director of football Johan Lange would dearly like to strengthen in the January transfer market.

| Position | Team | Played MP | Won W | Drawn D | Lost L | For GF | Against GA | Diff GD | Points Pts |

| 5 | 16 | 8 | 3 | 5 | 28 | 23 | 5 | 27 | |

| 6 | 16 | 7 | 4 | 5 | 24 | 21 | 3 | 25 | |

| 7 | 16 | 7 | 4 | 5 | 24 | 25 | -1 | 25 | |

| 8 | 16 | 6 | 6 | 4 | 24 | 22 | 2 | 24 | |

| 9 | 16 | 6 | 6 | 4 | 26 | 25 | 1 | 24 | |

| 10 | 16 | 7 | 2 | 7 | 36 | 19 | 17 | 23 | |

| 11 | 16 | 7 | 2 | 7 | 32 | 30 | 2 | 23 | |

| 12 | 16 | 6 | 5 | 5 | 23 | 21 | 2 | 23 | |

| 13 | 16 | 6 | 4 | 6 | 21 | 19 | 2 | 22 | |

| 14 | 16 | 5 | 4 | 7 | 21 | 29 | -8 | 19 |

Tottenham have been linked with Leeds United’s Pascal Struijk and Feyenoord’s David Hancko, both of whom would act as stand-ins for the injured Cristian Romero, for example.

Incidentally, Romero himself criticised ENIC and Levy for failing to match the investment of their rivals in recent year, bemoaning “always the same people responsible.”

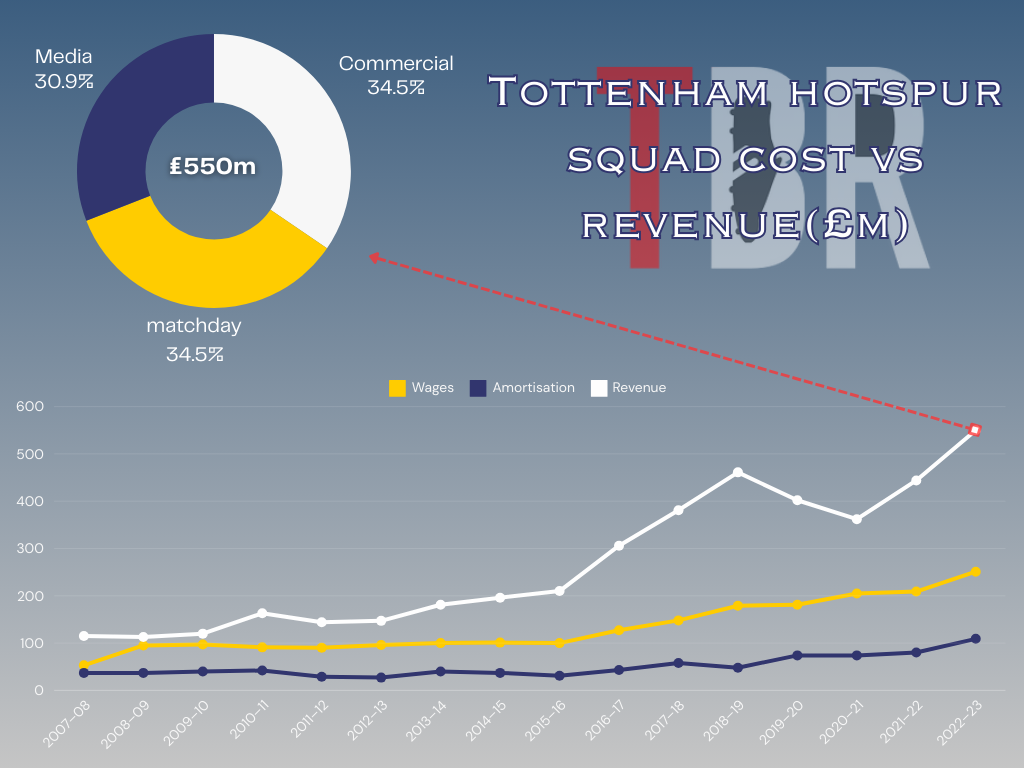

The standard riposte from Levy, who is the best-paid director in the Premier League, has been to point out that Spurs spending on wages and amortisation has risen steeply since the stadium move in 2019.

That is true, but the gap between revenue and investment in the squad is growing, and not in the direction that most Spurs fans would like.

Tottenham have no issues with either UEFA or the Premier League’s Profit and Sustainability Rules (PSR). In fact, they have more headroom that almost every other club in those areas.

If they do not spend in January then, it will be because the owners, either because of a lack of liquidity or a reluctance to break from their self-sufficient model, are not willing to sanction further investment.

Levy has pledged that some capital from any new minority investor, be that Staveley or another party, would go towards strengthening their teams.

But a share transfer as opposed to an equity injection would give the owners no obligation to redirect any funds back into the squad.

And at least some of the capital will go towards infrastructure projects, such as the hotel they are currently building at the Tottenham Hotspur Stadium.

What's Your Reaction?